Welcome to the June 2024 edition of Unbox. Access the latest edition here.

We’re halfway into a year that may be best defined as a fine balance between venture capital’s affinity for eternal optimism and a more recent inclination towards hard-nosed pragmatism. The ecosystem is still very much in the throes of a reset, one that is already catalysing the evolution of venture capital playbooks for India in the upcoming decade.

In this edition of Unbox, we unpack what’s changing in the ecosystem and where Lightbox is positioned; notable wins from the portfolio that set them up for long term gains; a sneak peek at a new micro-report we’re releasing soon; and the exciting community we’re building within the ecosystem for all to better navigate India’s exciting consumption market.

The big reset and playbooks for the next decade

While the downturn is far from over, murmurs of a thaw in the ongoing funding winter are gaining ground. Across the ecosystem, businesses able to demonstrate the ability to create tangible value at reasonable valuations are being able to access capital again. Caution dominates global investor sentiments but India’s vibrant innovation economy continues to be core to their asset allocation strategies.

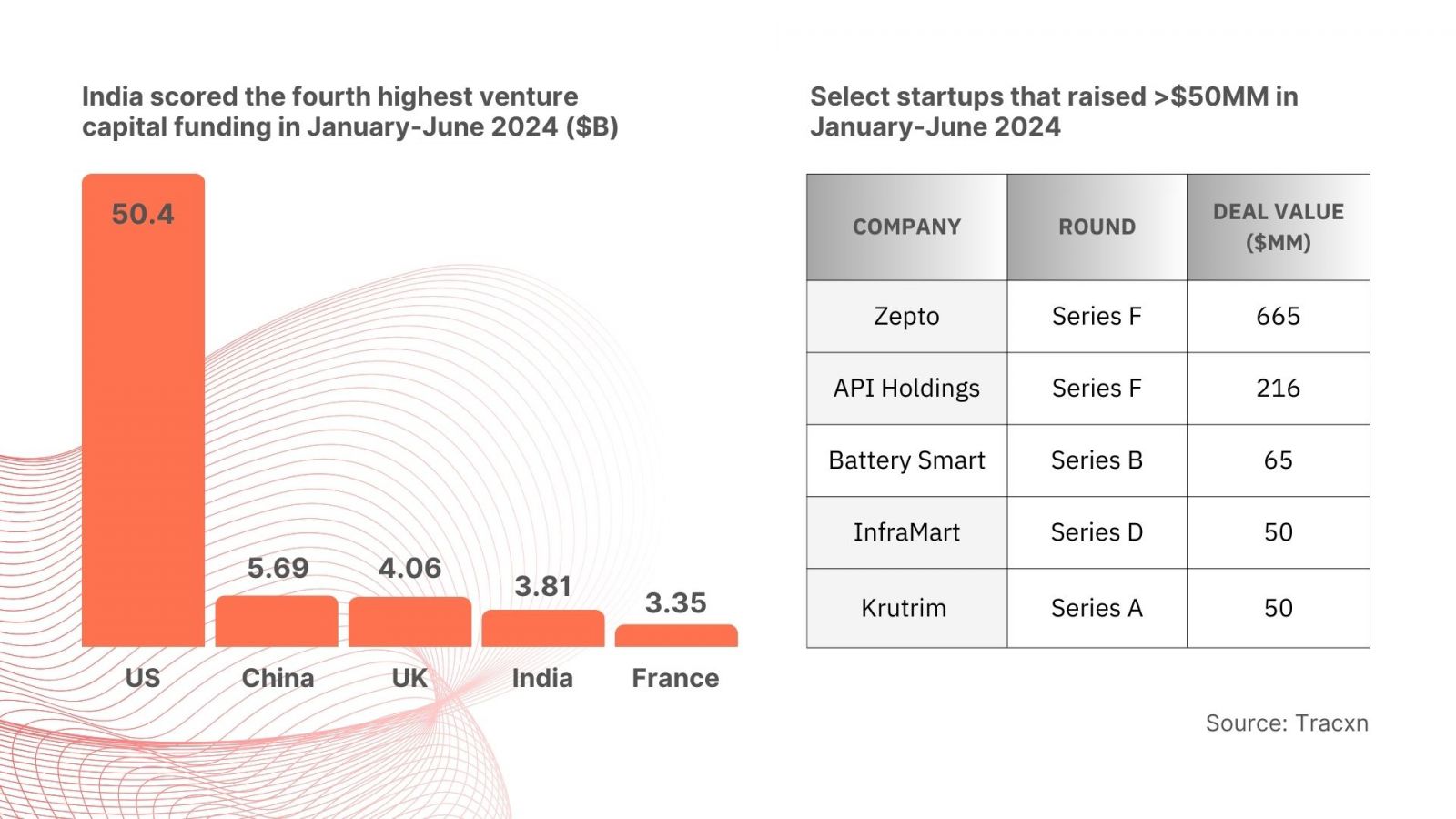

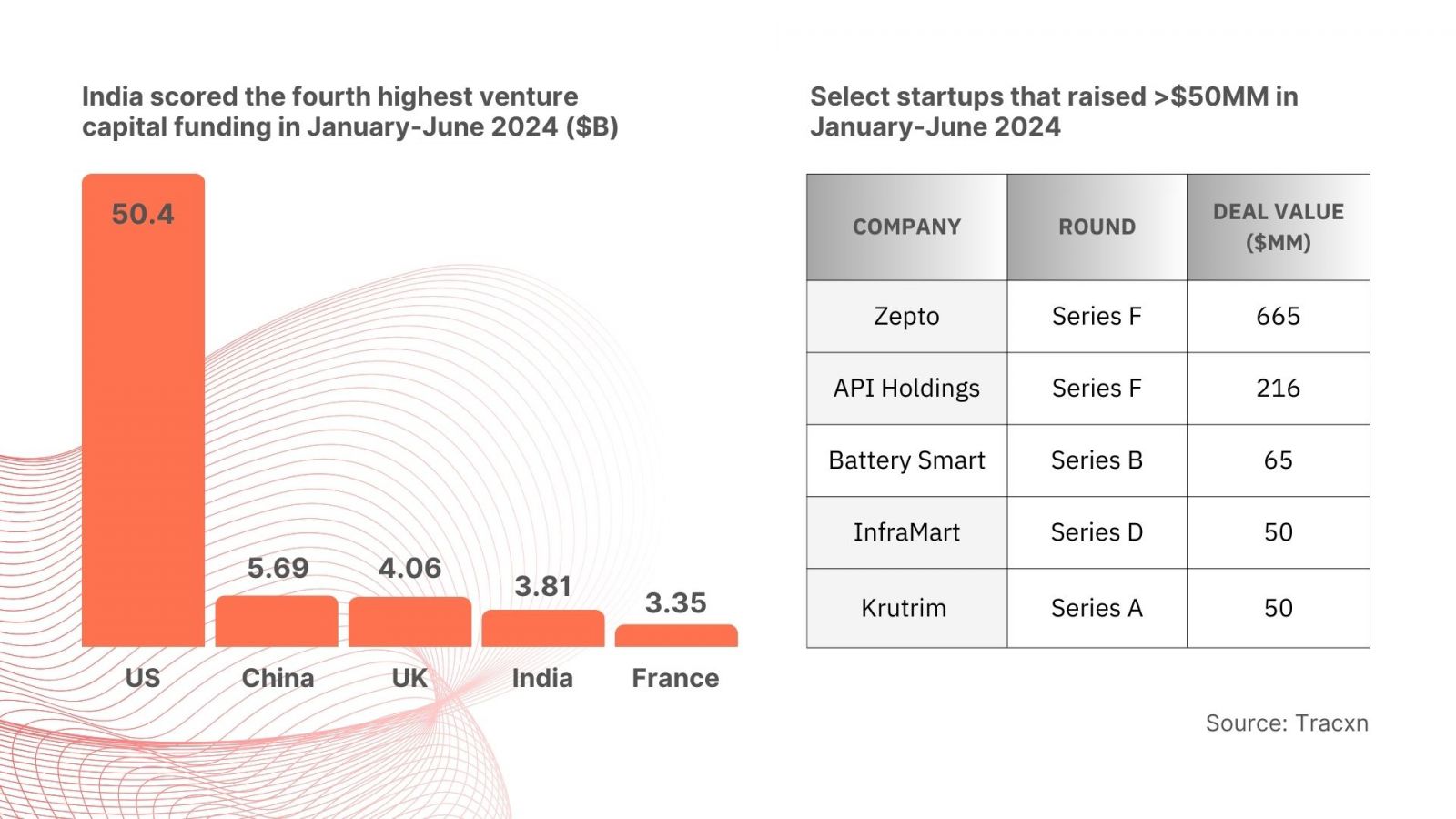

Early-to-growth stage startup businesses in India raised venture capital worth $3.81 billion during the first six months of 2024 — the fourth highest funded market globally after the US, China and the United Kingdom. Overall investments year-on-year were down 16.4% from the corresponding period in 2023, signalling ongoing pressure on capital flows. The number of funding rounds declined by 44% to 481. While fewer companies raised capital this year, the median deal size improved to $2.5 million in April-June 2024 against $1.5 million in the same period last year, per data compiled by Tracxn.

Three Lightbox portfolio companies were part of the rising tide in the first six months of 2024. Zeno Health snagged $25 million in a growth round; Amaha Health garnered nearly $6 million; and Bombay Shirt Company raised $6.5 million in a Series B round. Many more companies in our portfolio are at various stages of closing significant follow-on funding rounds.

India’s goal of becoming a $10 trillion economy by 2034 spells tremendous opportunities for venture capital to play a pivotal role in nurturing the businesses that will become important catalysts in getting there. Fashioning the right investment approach for this unique, complex and unpredictable market has never been more critical. The downturn has forced, some may contend, a much required reset and venture capital investors across the board find themselves recalibrating their approaches. Whether it’s General Catalyst establishing a direct presence with the acquisition of homegrown Venture Highway or Matrix Partners India decoupling from its overseas parent, a distinctly localised playbook is the key to navigating India.

We took that approach when we started up as Lightbox a decade ago. Like most venture capitalists, we’re eternal optimists. The bet we took on the potential of generating value from organising India’s vast and diverse consumption market forms the cornerstone of our investment philosophy. At the same time, we’ve employed hard-nosed pragmatism by taking a private equity approach to investing, collaborating with our founders to drive operational outcomes and eventually superior returns for our investors.

We’ve taken some hits (who hasn’t?) but our investment approach has enabled us to ride out the worst of the downturn. Companies in our portfolio have been able to access growth capital and the momentum in our carefully constructed ensemble of differentiated business models is getting stronger.

To read the rest of the newsletter, subscribe here.

Back to building for India. Let's make it happen!